The second step of your investing journey through DSR should be to screen through our Rock Solid Ranking in the search of your next potential purchase. Companies appearing in our ranking are either closely followed by our team or suggested by other members like you. You will also find all companies included in our DSR portfolios.

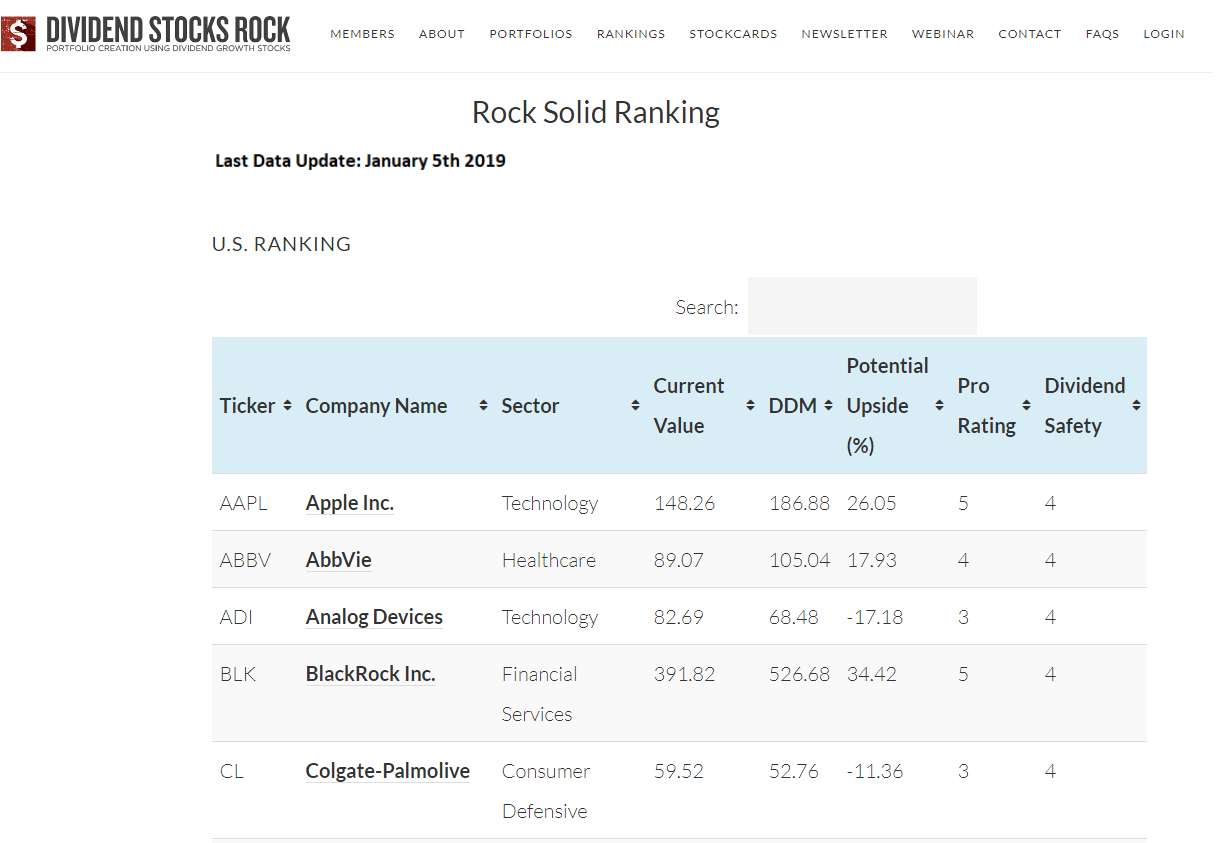

We rank each company according to their potential upside. Twice a year, we run a dividend discount model (DDM) calculation to complete our analysis of strong dividend growth business. Once a month, we update the current stock price value and calculate the potential upside (+) or downside (-) and publish it on the Rock Solid Ranking.

We know that each valuation methodology has its limits. The DDM will give you the value of a stock considering solely its dividend growth potential. There is definitely more to consider. For this reason, we also provide our members with a Pro Rating and a Dividend Safety Score:

Pro Rating

This rating gives you a score from 1 to 5 “stars” that can be interpreted as follows:

5 = Exceptional Buy – Everything is there; a strong business model, several growth vectors and an undervalued price.

4 = Buy – It’s a good company, the short-term upside is good but not flabbergasting.

3 = Hold – A classic “right company at the right price”.

2 = Sell – If we were you, we would seriously consider getting rid of this one.

1 = Screaming Sell – Enough said.

Dividend Safety Score

This score, from 1 to 5, tells you which kind of dividend policy you should expect. It can be interpreted as follows:

5 = Stellar dividend – Past, present and future dividend growth perspectives are marvelous.

4 = Good dividend – The company shows sustainable dividend growth perspectives.

3 = Decent dividend – Don’t expect much than a 3-5% dividend growth.

2 = Dividend is safe but – Not likely to increase this year.

1= Dividend Trash – It has been cut or is this situation is not sustainable.

This list is meant to be a tool to quickly identify buy opportunities. As each company have been handpicked according to our 7 dividend investing principles, the valuation model gives the final touch to select the right dividend paying shares for your portfolio. Here’s an example of what’s inside DSR:

The chart above is for example purpose only and is not being updated

Pick Undervalued Stocks in a Minute

As our Rock Solid Ranking is based on handpicked companies, you have the opportunity to cherry pick from the best basket already. This tool has been created to facilitate your investment decision by giving you a clear direction. Register now and get access to over 100 filtered stocks and their potential upside.