After an amazing year for the markets (2013), many of us were worried about the potential downfall of such a great bull market. After some mild results at the beginning of the year, the S&P500 was down by more than 5% in February. The US stock market is now up by almost 6% and by 12% since the first day of trading in February.

Do you still believe it’s time to sell your stocks and wait for the crash? I don’t think so. But regardless of what is going on right now, I invest for the long term. In May, I published the list of the top 10 Canadian dividend stocks for the next decade. I’m coming back today with my top 10 for the US market.

How the Best US Dividend Stocks Were Chosen

In order to start our selection, we went into our existing US portfolios along with our Rock Solid Ranking system. We looked at which companies we would be comfortable holding up for ten years. We considered their current metrics including sales, earnings and dividend growth over three and five years along with their dividend yield, dividend payout ratio and P/E ratio as we didn’t want to buy something at a very high price. Some stocks are not the best deal right now on the market as several great companies are fairly or overvalued at the moment.

On the other hand, if you wait on the sideline, the money market doesn’t pay very well for your patience and you might be better off by earning a 2.5-3% dividend yield in the meantime!

The Top 10 Dividend Stocks to Hold for 10 Years

Before we go into a complete report for all stocks, I wanted to give you my picks up front. Yeah… I know, the chart below doesn’t display the full list as I provide only 4 tickers. This is because the other 6 are for members only. There is a limit on the free stuff I can give, right 😉

| Company | Ticker | Dividend Yield | DSR Score | 1yr Return |

| Lockheed Martin | LMT |

3,31% |

59 |

48,10% |

| Microsoft | MSFT |

2,67% |

81 |

21,19% |

| Genuine Parts Company | GPC |

2,62% |

85 |

12,59% |

| McDonald’s | MCD |

3,21% |

70 |

2,02% |

|

2,36% |

93,5 |

86,57% |

||

|

2,01% |

78,5 |

65,07% |

||

|

2,64% |

73,5 |

23,30% |

||

|

2,39% |

96,5 |

25,51% |

||

|

2,88% |

69,5 |

5,44% |

||

|

2,55% |

76 |

1,06% |

||

Enjoy these four stocks and register to get the full report!

You Want To Read About The Other 6 Companies?

I wanted to be a nice guy and provide you with four interesting picks. But as the title suggests, I’ve made a list of 10 stocks to hold for the next decade. Only DSR members get access to the full report in our newsletter section.

Click here to read more about Dividend Stocks Rocks exclusive advantages!

Lockheed Martin (LMT)

DSR SCORE: 59

General Info:

Lockheed Martin is engaged in the research, design, manufacture and integration of advanced-technology products. It operates through 4 segments; Aeronautics, Electronic systems, Information systems & Global solutions and Space systems. In other words, Lockheed Martin is one of the biggest defense contractors in the world.

LMT benefits from a leadership position while many governments feel the urge to improve their security. The diversification of its income stream almost equally divided into their 4 segments (29%, 31%, 22%, 18%) offers them 4 different playgrounds to provide defense products. Over 2013, they consistently beat analysts’ estimates and are already focused on consolidation to reduce cost. This only means more profits in the future.

We expected the worst for LMT based on future US budgets. Since about 80% of its revenue comes from Government contracts, this remains a great risk. But Lockheed Martin seems to be able to navigate through this risk and manage its portfolio of products like champion. Revenues are stable and earnings are up throughout this tougher period.

The investing theory that there will be conflict around the world forever is good and the need to protect our country is still valid. Lockheed Martin is definitely showing a strong position in both markets.

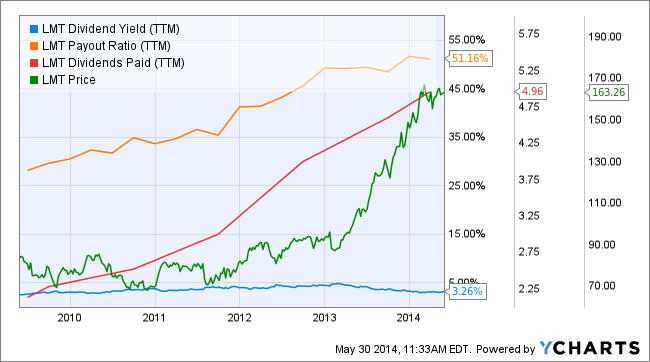

Dividend Profile:

When you look at LMT’s dividend profile, you automatically see that the yield is not as high as in previous years. Not so long ago, it was easy to find a period where LMT was paying over 4% dividend yield. The payout increases haven’t slowed down but the price has surged incredibly high since 2013. The stock is up by 53% over the past 12 months. This is enough to hurt a dividend yield.

Nonetheless, the payout keeps going up and the payout ratio is relatively stable around 50%. Once again, this gives LMT enough room for future increases.

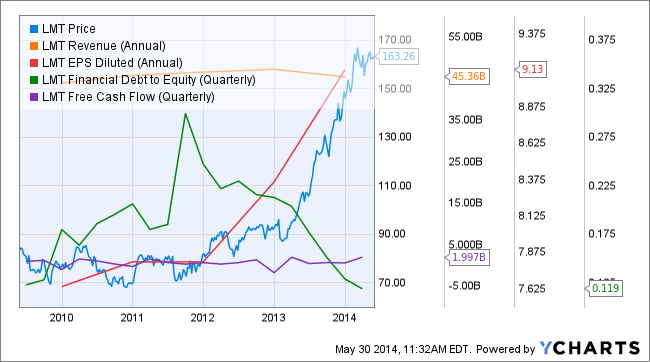

General Metrics:

As is often the case, the stock price followed the EPS trends while both are going very high, very fast. The company continues to generate a substantial amount of cash flow quarter after quarter which ensure enough support for both R&D and dividend increase. The debt to equity ratio has never been a concern but the recent stock rally pushed this metric to a very low level.

It will be interesting to follow LMT’s revenue trend for the upcoming years as the company won’t be able to generate such high EPS without more sales. This is not too much of a concern over the long run but you might want to wait a few more months before jumping onto this train if you are concerned about short term results in your portfolio.

Microsoft (MSFT)

DSR SCORE: 81

General Info:

Microsoft is the best known and most important software company in the world. Along with its famous software line of products, Microsoft also offers various services such as servers (including cloud systems), business solutions (support and consulting), entertainment (Xbox) and other online services.

Over the last 10 years, Microsoft has become a true dividend stock. It was one of the first techno stocks to start paying a distribution. Today, sales are relatively stable and the stock is paying a healthy dividend. With Windows 8, MSFT showed the world its ability to always renew its software product line. As long as Windows and Office will be used by corporate clients, MSFT will continue to grow by offering them their other services.

MSFT has been toiling in dangerous playgrounds while seeking market share from other Titans such as Apple, Google, Sony, etc. It constantly drains money to compete against such giants. If Microsoft is not careful with its spending, the situation could rapidly turn sour (we saw what happened with RIM).

But so far, MSFT has showed strong results and success with most of its adventures. Cloud computing seems to be the next big thing for companies such as Microsoft and I’m pretty sure it will keep a good market share in this lucrative market.

Dividend Profile:

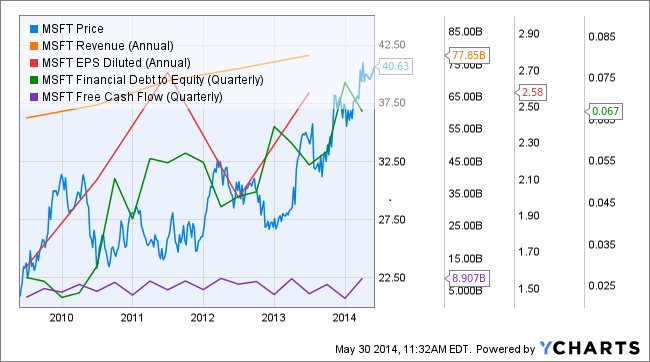

This Ychart dividend profile shows a drop in dividend payout to $0.74/share because I’m using the TTM (total trailing months) and dates weren’t aligned (and not counting latest dividend payout of $0.28). Therefore, the last 12 months of dividend payout should show $1.02/share and 2014 dividend payout will finish at $1.12 as the dividend was increased to $0.28/share at the beginning of this year. Yes, it’s always important to look twice at charts to understand them correctly!

With such a low dividend payout ratio and great uptrend in dividend increases, we can guess MSFT will increase its dividend payouts during the next ten years. Their core business model is almost impossible to attack (who talks about Linux now?).

General Metrics:

As a dividend investor, I like “cash companies” such as MSFT and AAPL. I don’t really mind if they are techno stocks and while they could go sideways on the next innovation – they are leaders in their industry and are sitting on tons of cash.

Revenues are on a steady uptrend which is very good for a mature company. This is because MSFT is constantly developing new markets and looking for investing opportunities. For better or worse, we will continue to use Windows on our computers for the next ten years!

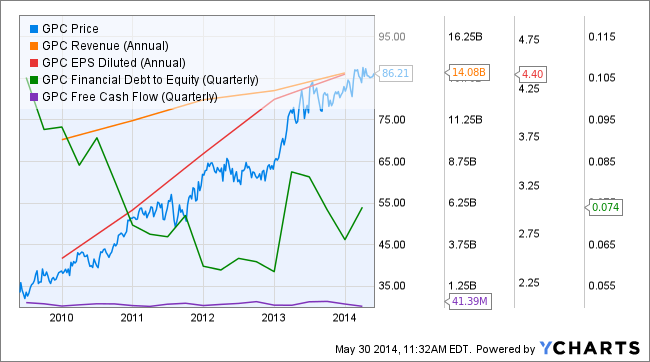

Genuine Parts Company (GPC)

DSR SCORE: 85

General Info:

Genuine Parts is another automotive and industrial part distributor. The Company operates in four segments: Automotive Parts Group, Industrial Parts Group, Office Products Group and Electrical/Electronic Materials Group.

When you look at the metrics, you can see that sales, earnings and dividend payments are all going in the same direction. We also believe in the car industry for 2014. GPC is another strong dividend aristocrat that should continue to raise its dividend this year.

While I like the numbers, I don’t like the fact that GPC failed to meet analysts’ estimates in past quarters. They were too optimistic at the beginning of 2013 and raised their guidance to disappoint 9 months later with lower than expected results. During their quarterly results in April 2014, they raised again their expectations for the rest of the year. Let’s hope they are right this year.

However, over the next decade, car parts will be in demand and GPC will be there to sell them. The company shows a strong balance sheet and the ability to increase its dividend for years.

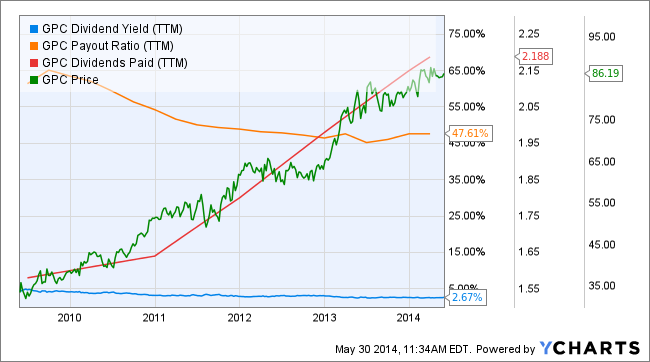

Dividend Profile:

When the dividends paid line crosses the payout ratio like this, you know you are looking at a company that is going in the right direction. Then again, many investors will tell me I’m looking at companies with low dividend yields, but I’m willing to take stocks with a yield under 3% if they show such quality.

Anyways, if you look at the dividend payout trend, you can see GPC is not there to keep their dividend yield low. The return based on the cost of purchase will quickly hit 3% and then 4%. Don’t be surprised if this stock pays 6% on your investment in ten years.

The key here is that the stock will also continue to go up and your total return will be more than respectable.

General Metrics:

GPC not only shows good results but it also grows by acquisition. In 2014, they bought Garland C. Norris, EIS, Electro-Wire and Impact products. GPC continually looks for companies to buy with revenues in the range of $25M to $125M. These bites are easy to chew on and don’t affect their balance sheet in a negative way.

Their ability to integrate new companies reflects in their earnings showing a steep uptrend. GPC will continue to be a leader in its industry and we won’t lack for car parts in the near future.

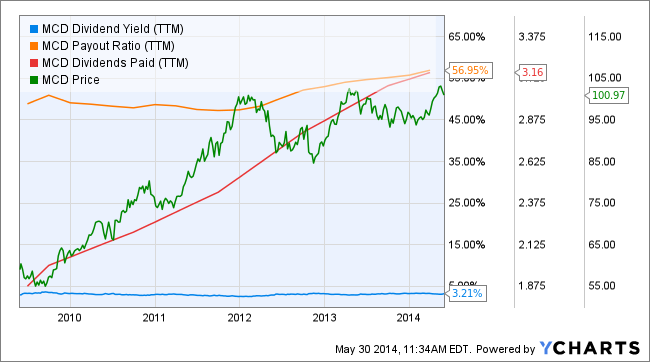

McDonald’s (MCD)

DSR SCORE: 70

General Info:

McDonald’s is the world largest fast food restaurant chain and operates in over 110 countries. They are known for the talent to select the best locations across the world. The past 10 years’ incredible stock performance is directly related to a major change in the company back in 2003. MCD invested massively in renovating its existing restaurants, expanded its menus (and added healthier food at the same time) and its hours of operation. These new measures combined with an aggressive franchise growth strategy in emerging markets contributed greatly to Mickey D’s financial results.

Its leader position in the fast food industry is definitely a strong point for MCD. Its proven ability to renew their menu and add high margin products such as coffee makes MCD a long term buy for any dividend investor. I also like the fact that MCD has been somewhat ignored by the market this year.

The overall grudge against low paid jobs in the restaurant industry may hurt MCD margins over time. I’m pretty sure the company doesn’t like seeing some of their employees on strike. The shift towards healthier products is well anchored but the brand image is already hard to modify.

Dividend Profile:

MCD dividend approach is exemplary as it is a model of stability and sustainability. Due to relatively stagnant sales since 2012, the payout ratio has increase a little bit but it is still very acceptable under 60%.

As you can see, the payout increases faster than the ratio which makes this higher-than-usual ratio not an issue. The yield is steady and it might be a good time to buy MCD, it pays over 3%. With such a track record, you can expect to earn 7%+ annually after ten years in your investment.

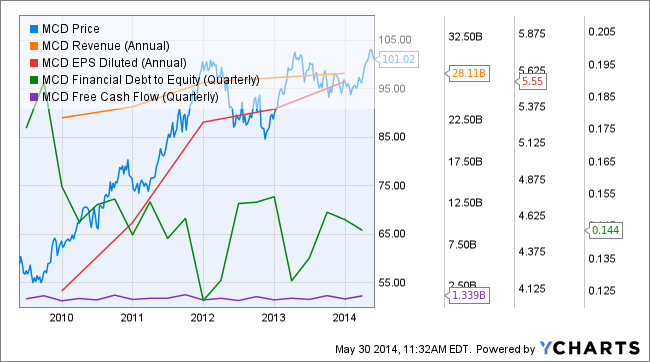

General Metrics:

MCD is currently a defensive stock for those who are afraid that the market will crash soon. Over the long term, it generates more income as it sells more franchises and increases its presence in emerging markets. Global expansion is still in the plans for the next decade.

As is the case with KO, MCD is another company that will strengthen your core portfolio for the long run and won’t disappoint when you consider its dividend payout.

disclaimer: I own shares of MCD and LMT