When you start digging into the world of dividend growth investing, you could find almost a hundred fundamental metrics and ratios to follow. But in all honesty, if you go hunting and follow all the metrics there are, you will spend your life digging into data and will not have any time to make any decisions.

Based on the 7 investing principles I follow to build and manage my portfolios, I’m sharing the only metrics and ratios you need to follow in order to build and manage a solid dividend growth portfolio. These principles are based on academic studies and have included a very specific set of metrics and ratios as followed.

Dividend Metrics

The first block of metrics to follow if you are a dividend growth investor is obviously dividend metrics. These are the most important metrics I follow for each company I study, buy, hold or think about selling. The dividend metrics are the backbone of my investing strategy.

Dividend Yield

When one thinks about dividend investing, the first thing that comes to mind is often the dividend yield. Many investors decided to use dividend stocks to create a supplement source of income or to generate their source of retirement income as a whole. This is why the dividend yield becomes really important to some investors.

Retirees for example will focus on higher yielding stocks in order to receive an adequate revenue derived from their portfolio. Unfortunately, I think they are wrong. Academic studies have proven many times that higher dividend stock yield underperform the market. When you ignore your investing needs and you focus on the rationale behind the yield, you will understand that it makes total sense.

Higher yield dividend stocks seems generous for one of the two following reasons:

#1 Their stock price dropped significantly upon bad news affecting the overall business

#2 The company has reached full capacity of dividend payments (higher payout ratio) and is viewed as a “luxury bond” paying better yield than regular bond.

In both cases, the company you are buying is not paying you a high yield for free. It’s either a risky play where the stock price may continue to drop, or worse, the dividend will eventually get cut. Or, you are buying a high paying dividend stocks that will not be able to increase its dividend in the future. Over the long haul, you will reduce your buying power as inflation will eat up your dividend yield without you even knowing it.

For these reasons, I rarely select companies exceeding a 5% dividend yield. Past this level, I consider the investment as a high dividend yield stocks and I would rather stay away from it. As a minimum level, I tend to favor companies paying at least a 2% yield, but I make regular exceptions if I find that the company shows a strong dividend growth potential. For example, I hold shares of Disney (DIS), Apple (AAPL) and Canadian National Railway (CNR.TO or CNI). They all paid less than 2% when I purchased them, but they are now paying a lot more. This introduces us to the second key metric to follow…

Dividend Yield on Cost

The dividend yield that matters is the one that is based on your cost of purchase. For example, when I bought shares of Disney back in 2012, its dividend payment was $0.75 per share for a dividend yield of 1.50%. 4 years later, the company has increased its yearly dividend payment to $1.42 (assuming no growth in 2016) and generate a 1.45% dividend yield. However, what really matters to me is how much I receive from my initial investment. This is why I consider the dividend yield based on the cost of purchase more important. Based on my cost of purchase, my Disney shares now pay me a yield of 3.00%.

This “magic” has been performed through a short 4 years. If the current dividend yield is stable through the years and there is dividend growth, this also implies that on top of receiving more dividend income, your holding has also grown in value. For any investor, you can call this a win-win situation.

If I keep my Disney shares for several years, this holding will eventually pays 3, 4 even 5% yield based on my cost of purchase. When you select a company with a strong dividend growth potential, you don’t have to worry about its current yield. You will eventually get your target in terms of this metric. Plus, if the company successfully increase its dividend year after year, you will not have to worry about inflation eating up a part of your retirement budget. In other words, if you can find dividend growth, you can find the “perfect holding”. This leads us to the following key metric…

Dividend Growth

The cornerstone of my investing strategy is based on this very metric. When you select a company with a strong dividend growth history and future dividend growth potential, you have literally hit the jackpot. I’ve mentioned it before, if I had to select only one metric to follow my holdings, it would be the dividend growth. A continuous increase in payments cannot lie; the company must have a solid business model in order to generate ever increasing revenues leading to ever increasing profits, leading to ever increasing dividends paid out. This is the only recipe that could make this theory happens.

I personally like to place more emphasis on the past 3 and 5 year dividend growth rate history. This tells me if the company has recently went through a flash increase in order to attract new shareholders or if this is part of a solid company policy that will last over the long haul.

In fact, I’m not after companies that have recently shown a strong dividend growth rate. After all, this could have been only a one-time chance to impress the market over a very short period of time. I’m after companies that have fundamentals strong enough to demonstrate a long history of dividend growth and continue to show the same potential in the future.

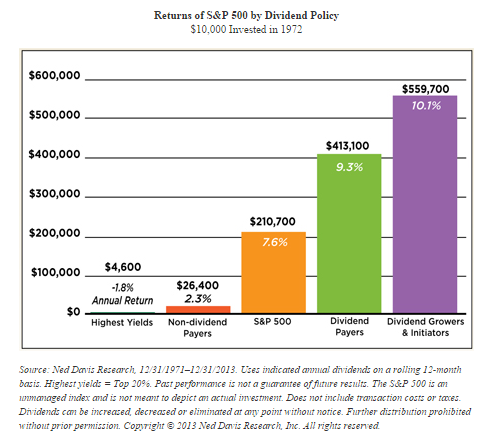

It has been proven by much financial research that dividend growers beat the S&P 500. The most complete research about this topic has been conducted by Ned Davis and shows a shocking result when it comes to compare dividend growers and other companies over a long period of time:

Dividend Growth Trend

On top of the 3 and 5 year dividend growth rate, a more important metric is how the payout has increased during this period. I would rather look at these metrics with a graph instead of getting a simple number. For example, imagine if management had decided 5 years ago to make a big dividend increase jump of 25% on year 1 because it was a very good business year and the outlook are promising. On year 2, the business is not doing as good and the dividend increase is set at 8%. Then, on years 3 to 5, the company increased their dividend by 3% per year. If you look only at the 5 years dividend growth rate without considering the trend, you might expect a future dividend growth of 8% (which would correspond to the 5 year annualized growth rate) while the reality is that you will likely be getting a 3-4% growth. When you get to the valuation section, such difference in growth rate will probably impact your decision on whether or not to buy a specific company.

Dividend History

While the dividend growth is very important, the company’s dividend history is also a crucial part of an analysis. Businesses with a very long history of dividend growth are more inclined to pursue their tradition. Management is well aware that if they only maintain their dividend payment after running a successful streak of 30 years with consecutive dividend increases, their stock will plunge like there is no tomorrow.

If a company has started to pay dividends only a few years ago, this will not stop me from buying it. However, I will tend to favor those which have been paying increasing dividends year after year for more than a decade. There are so many great companies showing such stellar dividend growth fundamentals that you don’t really need to look around for other stock picks.

Payout Ratio

One tool that can help you determine if a company can sustain its dividend growth is to look at the payout ratio. The payout ratio is calculated based on the amount of dividends per share paid in a year divided by its earnings:

Dividend paid per share / Earnings per share

For example, if a company declared a dividend payment of $0.50 quarterly or $2.00 annually and makes earnings per share (EPS) of $4.00, the company payout ratio is 50%.

Ideally, I’m searching for companies showing a payout ratio under 85%. I can extend to 100% if there is a very good reason, but I prefer companies that show room for more dividend payment increases even if they hit a tough period.

The reason why I’m willing to accept a higher payout ratio from time to time is that this ratio is far from being perfect. The main problem relies on the fact that the Earnings per share is a result of accounting calculations. If a company shows lots of amortization, it will improve its earnings but it doesn’t create any cash flow. The same thing if a company sells an important building in order to rent it further down the road, it could create a pop in the earnings but this is not sustainable. This is why I also use another type of ratio to determine if the company’s dividend growth potential is sustainable or not.

Cash Payout Ratio

The cash payout ratio is the second ratio related to the company’s dividend growth potential. While the classic payout ratio uses the earnings per share to determine if a company can pay its shareholders or not, the cash payout ratio will use the cash flow available to distribute. What I like about the cash payout ratio is the fact that we are looking at the reality of the business. This ratio answers a simple but very important question:

Is there enough cash in the bank account to pay shareholders?

This is opposed to the accounting world where earnings can be temporarily manipulated, the cash payout ratio is derived from the company’s bank account. If there is enough cash coming in, the company will show a cash payout ratio under 100%. If it’s not the case, even though the payout ratio is under 100%, it will show you that the money used to pay dividend can’t come from the company’s bank account. It will have to come from a line of credit or another way of financing (loans, bonds, shares emissions, etc). In order words, if the cash payout ratio is over 100%, the business will not be able to sustain this situation very long. Something will have to happen. Either the company will improve its financial situation and bring it back under 100% or it will fail to increase its dividend. These are the companies you don’t want in your portfolio.

This concludes the first part of the key metrics and ratios to follow. Focusing on dividend payouts is important, but one must not ignore the forest behind the trees. This is why it is also important to look at other metrics and ratios when you are using a dividend growth investing strategy.

Fundamental Metrics

While dividend metrics are important, there are means to find if they will continue to exist. This is why it is also important to follow a few fundamental metrics and ratios. All these numbers are still oriented towards dividend growth over time, but will tell you how the business is doing in general.

Revenue Trend

The basic role of every company is to generate sales. If one makes sales, it has a chance to make a profit and eventually pay out a dividend. But it all starts with its core business making sales or not. This is why I like to look at the 10 year revenue trend to see where the company is going. I don’t necessarily look for a perfect up trend of 10 consecutive years. I’m more interested in the overall trend and what explains if the company had good or bad numbers. For example, between the period of 2012 and 2016, many US companies had a hard time showing positive growth at one point or another during this period. Most of the explanation came from a strengthening US dollar vs other currencies. It is hard to post US dollar revenue growth when half of your revenues comes from offshore and your currency gained 12% against other currencies during the same year.

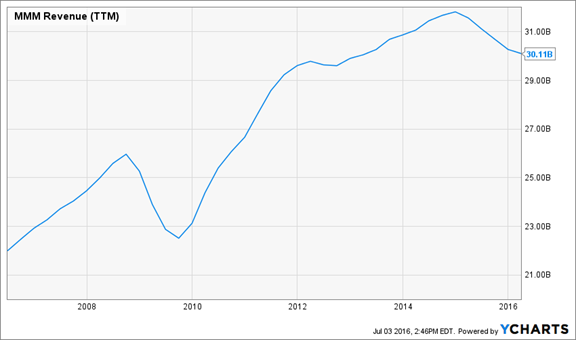

The revenue trend will also tell me if the company has been able to find other growth vectors away from mature markets or if it simply following the wave and waiting to die a slow death. A company like 3M Co (MMM) has been able to successfully find new growth vectors both from internal and external solutions.

Source: Ycharts

Earnings Trend

Similar to the revenue trend, the earnings trend will tell me more about the company’s ability to increase its profit year after year. It is one thing to generate sales, but if you are not able to maintain or improve your margins, your earnings will eventually get hurt.

For example, the years 2012-2016 has been very hard for Lockheed Martin (LMT) as the US government was putting a hold on its military needs. This is why their revenues trend was not quite impressive to say the least. However, if you look at their earnings trend, you will notice the company was able to improve their margins and make significant moves in order to generate more earnings.

Source: Ycharts

The company ability to improve its earnings during a tougher sales period is a great indication that it will be able to pay even more money back to their shareholders during better times. When you can find companies that are able to improve their earnings during tough times, it is a great opportunity to buy them now and reap what you sow when the good times are back.

Free Cash Flow

As a dividend growth investor, the revenues and earnings are crucial for me as they will give me a good indication if the company will be able to increase their payouts or not. However, a crucial metric remains the company’s ability to generate free cash flow. Without this cash flow, the dividend payment has to be paid from new debt or cash raised from new share issuance. Both solutions that are not really helping the company’s overall structure. Always remember that earnings are based on accounting principles and this is not what pays dividends with cash.

Debt to Equity Ratio

While revenues and earnings are crucial for any dividend paying companies, their debt level is also of interest. In order to monitor them, I like to use the debt to equity ratio. This ratio tells me which kind of financing management prefers; do they privilege more debt from banks or selling more shares and diluting ownership. It is important that the company focuses on using its own cash flow to grow instead of counting banks or the markets. In both situations, when the market goes sour, the company has a very hard time to meet its financial obligations.

I prefer a lower amount of debt versus equity simply because debts are usually less flexible. Loans come with a contract, an agreement between the company and the bank, with rules and payments to follow. When the company issue more shares, it hurts the ownership quality, but management will also have the opportunity to buy back those shares at their will. This makes it a more flexible way of financing their business activities.

Stock Price trend

I always look at the past year, 3 and 5 year stock trends of a company to see how the market has seen the stock in the past. I’m not omniscient and I don’t think I’m smarter than Wall Street. This is why I want to know what the big guys think of my future holding before pulling the trigger.

I’m not that interested in strong uptrends or downtrends to find a good company. What really interests me are the reasons why the stock has gone up, down or did nothing. When I can explain past fluctuations, It is a good sign where I understand the company I’m about to invest it. If I can’t, I’m probably missing a part of the puzzle and I’m better off following Warren Buffett’s advice:

Invest in businesses you understand.

This concludes the fundamental metrics I follow. As you can see, I don’t have a list of a dozen metrics. I’ve handpicked these, which are in line with my investing strategy and what will affect dividend payouts over the long run.

Valuation Metrics & Ratios

Finding a company with strong metrics is one thing. Finding a company with strong metrics that hasn’t reached its intrinsic value price is another. At DSR, we think a good company is always a good buy. Following our 5th investing principle, we invest when we have money in hand. This doesn’t mean that we need to buy any stock at any price. We focus on companies that are undervalued momentarily for a variety of reasons. This is why we use several valuation methods to determine a fair price for each stock.

Before we start this section, I must remind you that evaluating a stock is half science, half art. Most of the stock price you establish will be as solid as your assumptions. It is extremely difficult to foresee the future and assign the right price to any company. However, we believe that with a combination of various valuation methods, metrics analysis and ratios understanding, we can find a good intrinsic value and make the right buy decisions.

PE Ratio

The first ratio used is a classic method of the Price/Earnings Ratio. We use a 10 year history of PE ratio to see how the stock market appreciates the company. This simple graph will tell you a lot about how the Street has seen events influencing the company you are looking at. For example, you can see the following graph of MMM PE:

Source: ycharts

At the moment, it seems obvious that MMM is trading at a higher level than usual. Further digging is required to see if it’s justified or not.

Price to Book Ratio

The price to book ratio is an easy metric you can find that will tell you how much the company worth when you think about its book value. This will help you give a number that is less emotional and less shortsighted. I never base any decision on this ratio, but it is another interesting metric to consider.

Price to Free Cash Flow Ratio

Similar to the price-to-book ratio, the free cash flow ratio is easy to find on any finance site. It will give you how much the company is valued compared to its ability to generate cash flow. As a dividend growth investor, you must already know that cash flow is king. The Price to free cash flow ratio is another “soft” indicator that will help you in your decision. However, my favorite technique is the one below.

Dividend Discount Model Metrics

The Dividend Discount Model or DDM treats a single share of stock as a machine that outputs free cash flows, in the form of dividends. It uses the same theory and math as discounted cash flow analysis, but treats the dividend as free cash flow, since from an investor’s standpoint, that’s the free cash that you actually receive. In this model, which was developed many decades ago by investors and is a common valuation method, you sum up all future estimated dividends, discount them at an appropriate discount rate, and therefore receive an output for what the intrinsic value of a share of this company is. It’s exactly like the cash machine example.

There are some advantages and disadvantages to this approach. The advantages are that it’s simple and straightforward, and the dividends are actually paid to the investor. (Free cash flow, on the other hand, could potentially be squandered by management. You have to check to ensure that it’s not, and instead is spent on dividends and/or reasonably-priced share repurchases). The disadvantage is that since the dividend growth rate already takes into account company growth and share repurchases, the growth rate will be fairly high, so we’ll have to use a fairly high discount rate, and so it’s very sensitive to the inputs. If our inputs are off by even a little, then the outputs will be off by a lot. So we’ll have to be quite prudent.

I personally use the Double Stage Dividend Discount Model explained in the Dividend Toolkit. If you are a member of Dividend Stocks Rock already, you can download the book for free (retail value of $19.99) and use its excel calculator in order to build one yourself.

The Double Stage DDM enables you to choose two different dividend growth rates. A first one for the first 10 years that will reflect best the current situation of the company and another one for the years after that should correspond to a more conservative number in order to make a strong assumption.

Discount Rate

The discount rate means the rate of return you are expecting from your investments. This also includes the level of risk of this investment. For example, you can’t expect a 10% rate of return from Treasury Bills since there is virtually no risk. The expected rate of return should correspond to a mix of how much you expect to generate in your portfolio vs the risk level represented by a specific company. I use a range of 9 to 12% as a discount rate.

9% = Companies with a very strong competitive advantages + stellar balance sheet + strong dividend growth history (10 years + with consecutive increase).

10% = Companies showing 2 out of three items mentioned above.

11% = Companies with a higher level of risk.

12% = Definitely a long shot and this should not represent more than 3% of my portfolio.

Dividend Growth 10 years

The dividend growth use for the first 10 years is usually the easiest metric to determine in this calculation. I usually look at the past 5 years dividend growth history to see how the company has been doing and read more about management’s dividend policy in their annual statement. Some companies are generous enough to give a precise idea of their dividend growth policy for the next 12 months to 3 years. This also help me to determine what the next 10 years will look like.

I always take a look at the current payout ratio and cash payout ratio as previously mentioned in the “dividend metrics” section. If the company was able to sustain a 8% dividend growth rate over the past 5 years and the payout ratios are still under 60%, you can expect management to continue this pace for a while.

Dividend Growth for the years after

While the 10 years dividend growth rate is relatively easy to figure out without making any mistakes, choosing a dividend growth rate for forever is another story. If you get too optimistic, you will quickly find that all stocks are undervalued. This is why it is important to remain conservative in the choice of your growth rate.

When selecting growth rate for a very long term, I always take a pause and think about the company’s future. What could go well? What could go wrong? What the business might look like 10 years from now? Will we need the company’s products or services going forward?

These are not easy questions to answer and this is why it is important to understand what the company’s business model is all about and what it does to make money. If you invest in a company with strong metrics and ratios but you don’t understand what they are doing, it will be difficult for you to make correct assumptions.

In order to illustrate the impact of each metric, we will conclude this very long article with an example of a dividend discount model as we use it at Dividend Stocks Rock.

Example of Dividend Discount Model Applied

In order to show you how the dividend discount model works, I’ve chosen one of my favorite companies; 3M Co (MMM). The company has historic dividend growth for 57 consecutive years. It shows a 52.99% payout ratio and a 51.64% cash payout ratio. MMM has increased its payout by 11.29% CAGR over the past 5 years with a steep increase in 2015.

MMM finished 2015 with a dividend per share paid of $4.10. This is the number I will use in this example. In fact, you could read this example in 2025 and it will still work even though MMM‘s dividend payment will be different.

MMM is a leader in its industry and shows a stellar balance sheet. It also operates various divisions in many countries. This is perfect example of optimal business model diversification. The company also shows roughly 50% of its sales as repetitively purchased goods leading to constant cash flow generation. For these reasons, I will use a 9% discount rate.

The company has shown a very strong dividend growth rate over the past 5 years. However, I don’t think it’s reasonable to keep a growth of 11.29% per year for the next 10 years. More conservatively, I will use a 8% for the first 10 years. Then, for the long haul, I think it’s reasonable to assume a 6% growth rate for the years after.

Here are the metrics I’ve used to do my calculations:

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $4.44 |

| Enter Expected Dividend Growth Rate Years 1-10: | 8.00% |

| Enter Expected Terminal Dividend Growth Rate: | 6.00% |

| Enter Discount Rate: | 9.00% |

And this is how the Toolkit calculation spreadsheet gives me:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $335.66 | $222.34 | $165.75 |

| 10% Premium | $307.69 | $203.82 | $151.94 |

| Intrinsic Value | $279.72 | $185.29 | $138.13 |

| 10% Discount | $251.75 | $166.76 | $124.32 |

| 20% Discount | $223.78 | $148.23 | $110.50 |

Source: dividend toolkit calculation spreadsheet

As you can see, the intrinsic value of MMM is $185.29. The 15-cell matrix also shows me what would be the valuation if I had taken an 8% or 10% discount rate. It also calculates a margin of safety. This margin is used to show you how the current stock price is close or far from your evaluation. When you are able to select company trading at a 20% discount, you know that even if your assumptions are not perfect, you have a very good margin of safety.

Now, imagine that I would have taken a 11% dividend growth rate for the first 10 years and use a 7% for the years after.

| Input Descriptions for 15-Cell Matrix | INPUTS |

| Enter Recent Annual Dividend Payment: | $4.44 |

| Enter Expected Dividend Growth Rate Years 1-10: | 11.00% |

| Enter Expected Terminal Dividend Growth Rate: | 7.00% |

| Enter Discount Rate: | 9.00% |

I would get a complete different valuation:

| Calculated Intrinsic Value OUTPUT 15-Cell Matrix | |||

| Discount Rate (Horizontal) | |||

| Margin of Safety | 8.00% | 9.00% | 10.00% |

| 20% Premium | $811.93 | $400.85 | $264.05 |

| 10% Premium | $744.27 | $367.45 | $242.05 |

| Intrinsic Value | $676.61 | $334.04 | $220.04 |

| 10% Discount | $608.95 | $300.64 | $198.04 |

| 20% Discount | $541.29 | $267.23 | $176.03 |

3M Co valuation now jumps to $334.04. Do you think it’s realistic? If such a well known company was so amazing, don’t you think that many institutional investors would have made a major purchase in MMM thinking the price could skyrocket over $300 over a short period of time? This is why using the past 5 years growth rate is not always a sound idea. The longer you project a company’s metrics and ratios into the future, the more important your margin of error is. When you project an infinite dividend growth rate, it is crucial to remain conservative in your assumptions.

Final Thoughts on Key Metrics and Ratios used for Dividend Growth Investing

While this was a lengthy article, I think it was necessary to create a resource page including the complete list of metrics and ratios we follow in order to build our portfolios. You can see our portfolio performance since 2013 here. We try to keep our method both simple and efficient at the same time. We have taken years to build a solid investing strategy and the payoff is starting to show in our results. There are obviously several other metrics and ratios you could include or take out from our investing process. This is definitely not the only method to be successful with your investment. But this is a good starting point if you are looking to build your own strategy.